In today’s world, where more and more customers prefer cashless payments, a POS terminal has become an essential part of doing business. It enables fast and convenient acceptance of card, mobile phone or watch payments, which can positively impact your sales and customer satisfaction. But how do you choose the right payment terminal?

What is a payment terminal?

A payment terminal, also known as a POS terminal, is a device that allows accepting payments by card or by mobile payment apps like Google Pay or Apple Pay.

You’ll find it in retail stores, restaurants, hotels, festivals and markets - basically anywhere cashless payments need to be processed.

Types of payment terminals

- Countertop (stationary) terminals.

Ideal for brick-and-mortar stores where the terminal is fixed at the checkout. - Handheld (mobile) terminal.

Allow accepting payments anywhere thanks to internet connection (Wi-Fi, 4G). - Smart POS.

Advanced terminals with a touchscreen and additional features. - Soft POS

An app that turns a smartphone into a POS terminal.

Benefits of having a POS terminal

According to a Mastercard survey, up to 69% of people are discouraged from making a purchase if the merchant does not offer a card payment option. Having a POS terminal brings several benefits:

Higher sales – customers are willing to spend more when they don’t have to worry about cash.

Faster payments – card or mobile payments are faster than cash handling and help reduce errors.

Better customer experience – allows convenient payments without the need to look for an ATM.

Security – less cash means lower risk of theft.

Simplified accounting – transactions are digitally recorded, giving you clear oversight.

Key factors when choosing a POS terminal

When selecting a POS terminal, consider these aspects:

- Fees. Compare transaction fees and fixed costs. Watch out for hidden fees from some providers.

- Payment method support. Check which types of cards each terminal accepts. Don’t forget meal and benefit cards.

- Useful features. Think about which features are important for your type of business and what capabilities the terminal should have.

- Integration with your cash register. Make sure the POS terminal connects with your accounting software and cash register systems.

- Reliable customer support in your native language. Access to customer support and the ability to resolve issues quickly is crucial in today’s competitive market.

24pay POS terminals – benefits you won’t find anywhere else

Looking for a reliable POS terminal? 24pay offers trusted solutions that simplify your business operations and come with clear, fair terms.

FIRST 6 MONTHS FREE. You won’t pay anything for your POS terminal service during the first six months - with no strings attached.

MONTHLY REWARD FOR USING YOUR TERMINAL. Earn up to €25 per month for transactions processed through your POS terminal - no limits on how you spend it.

SUPPORT FOR ALL PAYMENT METHODS. 24pay terminals accept all major cards including VISA, Mastercard and popular meal and benefit cards like fpoho, Edenred and UP. Naturally, Apple Pay and Google Pay are also supported.

USEFUL FEATURES

Add tips, operate multiple businesses on one device (multi-TID), display a payment reference on receipts or use pre-authorization to temporarily hold a specific amount before final payment - and more. These features can streamline your business and even help reduce costs.

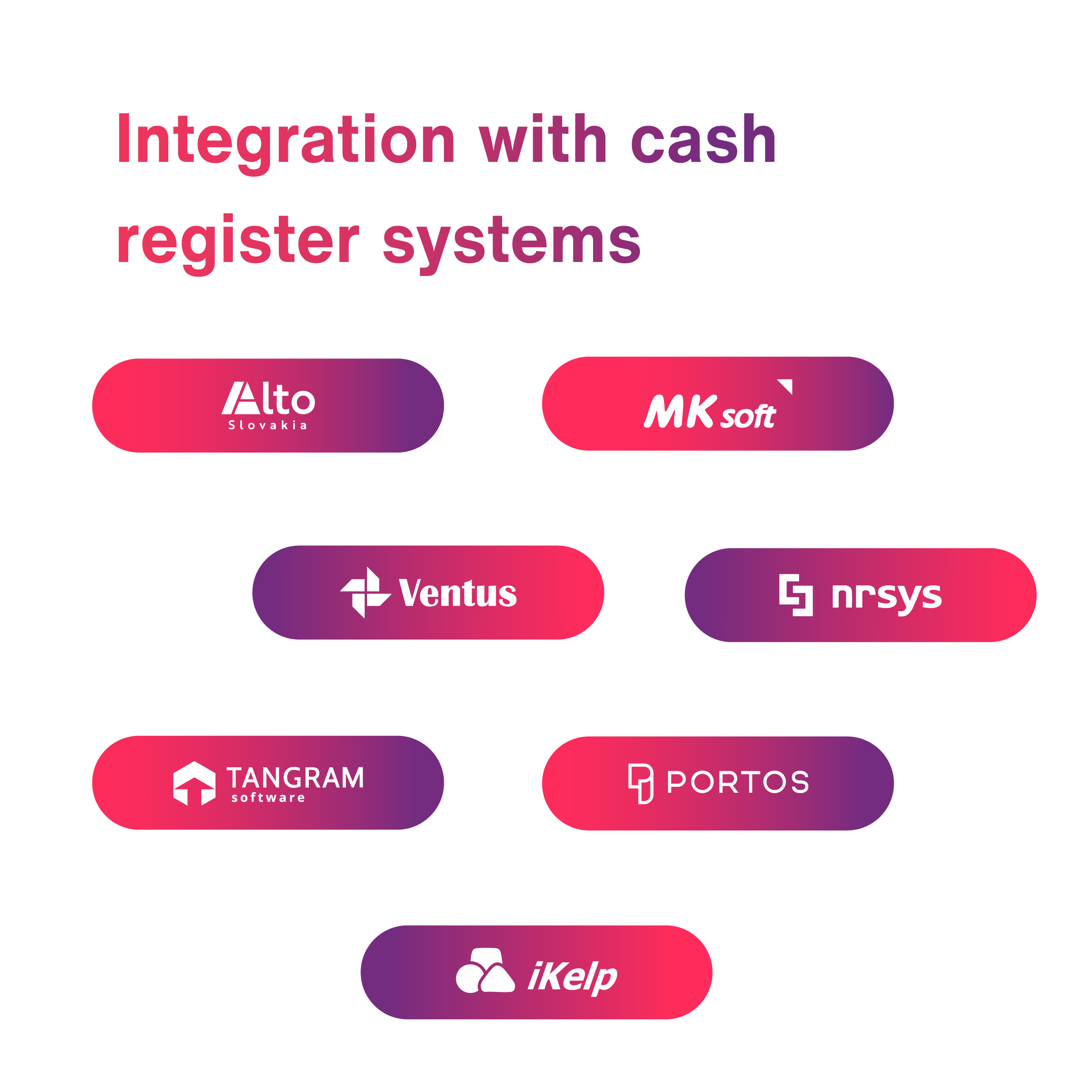

INTEGRATION WITH THE MOST POPULAR CASH REGISTER SYSTEMS

SUPPORT AVAILABLE DAILY

Our technical support and consulting are available every day from 7:00 AM to 10:00 PM – including weekends and holidays.

How much does a 24pay payment terminal cost?

Rental fees for POS terminals vary depending on the type of device, ranging from €14 to €23. However, a monthly reward of up to €25 allows you to reduce, fully offset or potentially profit beyond the rental fee.

Transaction fees are set individually for each client.

Interested in learning more? Check out our blog post Keep your customers with modern POS terminals. Or get in touch, we’re here to help you find the right solution!